EMV® Gets a Foothold in the U.S.

Articles|Blog|Payment Cards

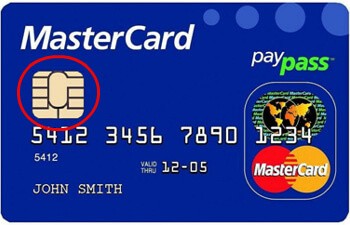

Over the past decade, EMV® chip-enabled cards have become the new global standard, replacing magnetic strip cards, to combat card theft and fraud and provide more secure transactions. The U.S. market, however, has been slower to adopt the standard of payment. Incidentally, many merchants have been reluctant to install EMV® compliant POS systems because many EMV® cards are backwards-compatible, allowing transactions to be processed via magnetic-strip readers. But many major card providers in the U.S. have already begun rolling out EMV® cards to cardholders, and it’s likely that you’ll see customers paying with EMV® cards with great frequency in the years to come.

A study conducted by Statista, and online statistics portal, projects that by the end of 2016 around 84% of credit cards will be EMV®, by the end of 2017 around 95%, and by 2018, virtually all credit cards will have adopted EVM standards in the U.S.

Visit Swypit.com to learn more about updating your POS system(s) to be EMV® compliant!